- 25 Jul 2024

- 1 Minute to read

- Print

- DarkLight

Reversing a Cash Receipt

- Updated on 25 Jul 2024

- 1 Minute to read

- Print

- DarkLight

Reversing a Cash Receipt

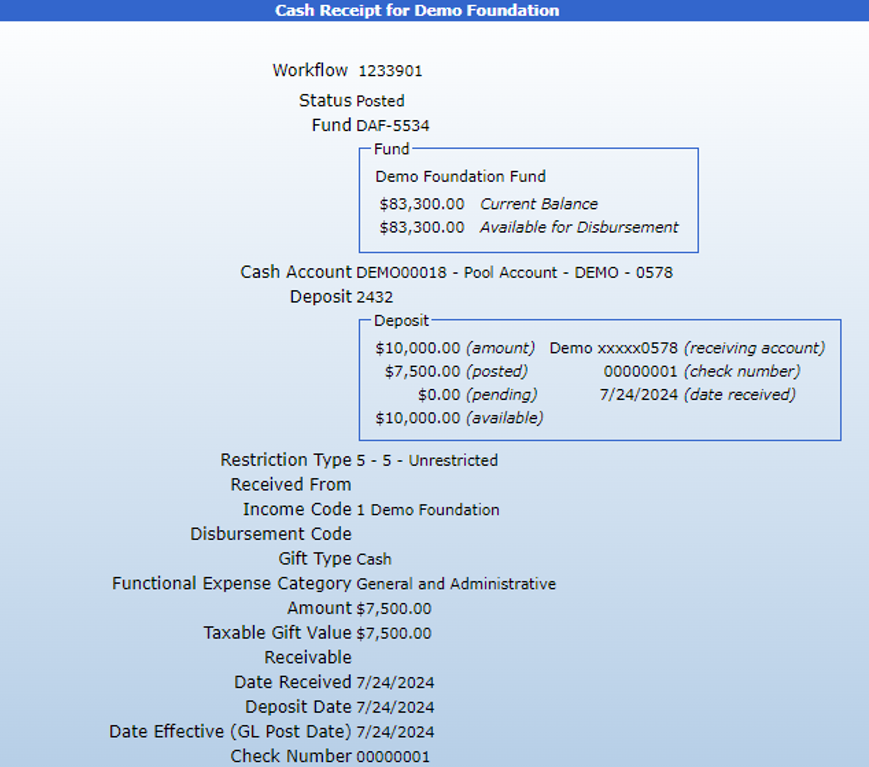

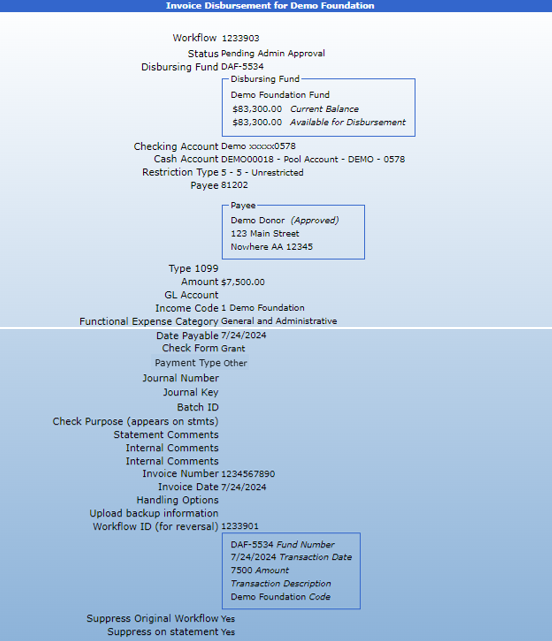

A cash receipt transaction can be reversed using the Invoice Disbursement form. See example transaction:

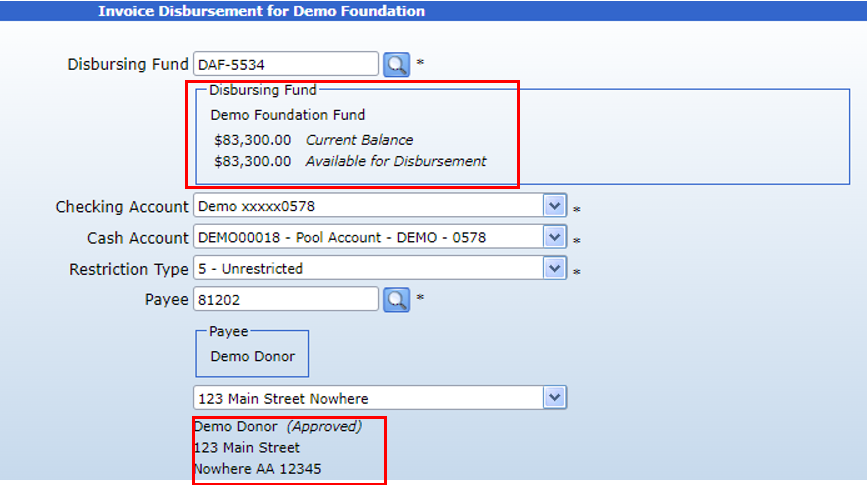

Enter the fund where the money was deposited into the Disbursing fund field. Then, in the Payee field, enter the IP who appears in the “Received from” field on the cash receipt transaction. You may have to select “Interested Parties” in the search box for the IP to appear.

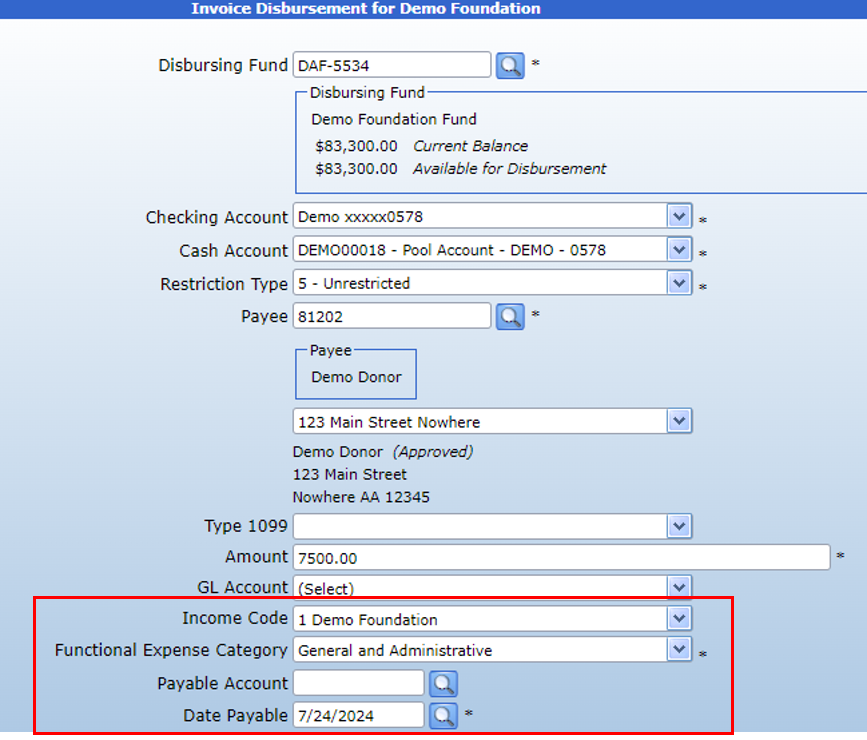

Then, enter the amount received in the cash receipt. Enter the same Income Code and Expense Category as used on the cash receipt. Then, select a date payable.

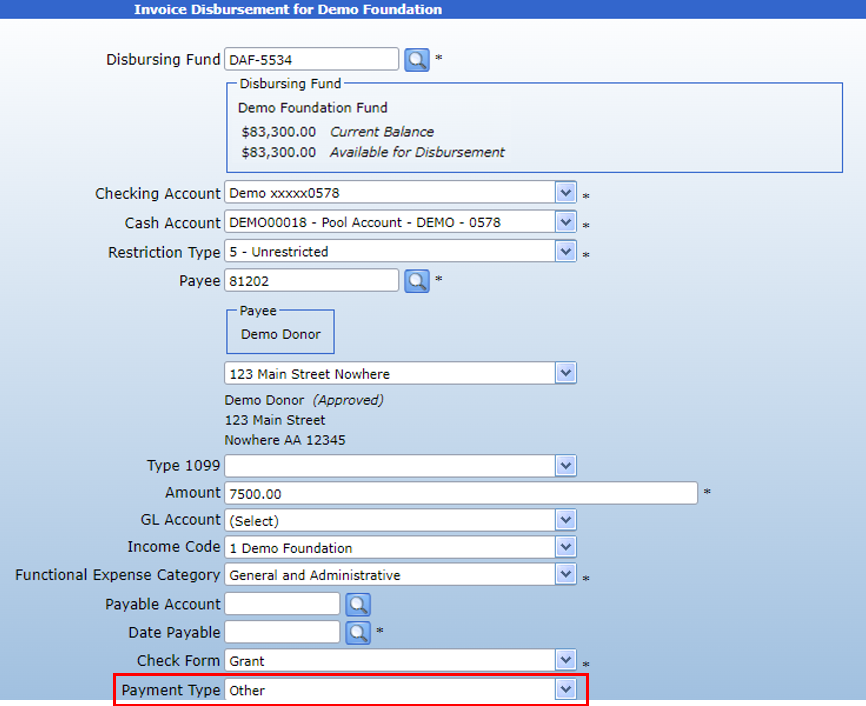

Set Payment Type to "Other" to ensure that a letter is not created for the donor.

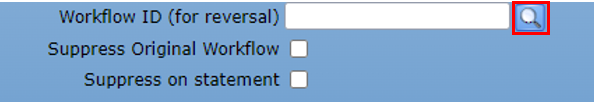

To reverse the cash receipt, use the Workflow ID search to find the original transaction.

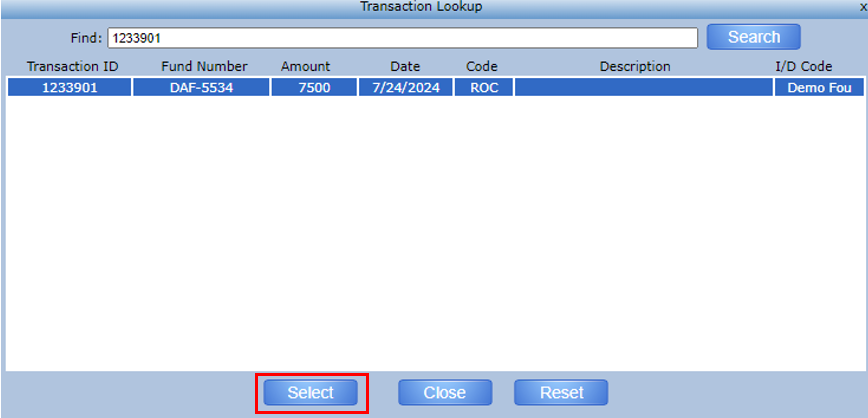

Click to highlight the desired transaction and click Select to attach it to the form.

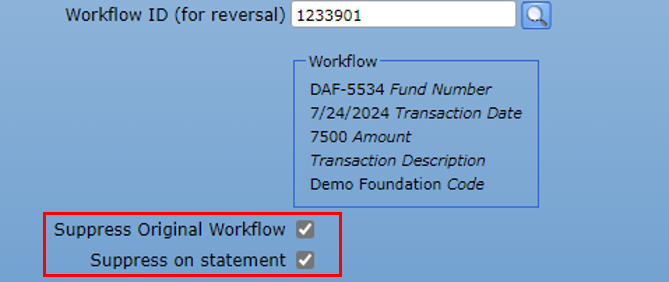

To suppress the transaction on a donor’s statement and their Fund Profile, click Suppress Original Workflow and Suppress on statement.

Enter comments as necessary and click Submit. This will forward the transaction for approval.

Once the transaction has been fully approved, the money should be removed from the fund and the original cash receipt transaction should be hidden.